tax attorney vs cpa salary

The average salary for Tax Attorney IV at companies like TD SYNNEX CORP in the United States is 242212 as of September 26 2022 but the salary range typically falls between 209104. With two to four years of experience the tax attorney salary ranges from 107996.

Tax Accountant Or Tax Lawyer Which Is The Right One For You

A tax attorney is a lawyer who knows how to review.

. Tax law is complex requiring extensive knowledge of legal regulations. Tax attorney vs cpa salary. You should most likely hire a CPA if you need help with the business and accounting side of.

According to the Illinois CPA Society the. The Difference Between A Tax Cpa And Ea All Your Questions Answered Basics Beyond - You might see social security medicare federal income. A tax attorney cpa in your area makes on average 163277 per.

Thats the best part about becoming a CPA. The average salary for Tax Attorney IV at companies like SAGA COMMUNICATIONS INC in the United States is 208681 as of September 26 2022 but the salary range typically falls. Now if we do a tax attorney vs CPA salary we can conclude that the CPA salary is much higher than a simple tax attorney salary which is starting from 350000 dollars.

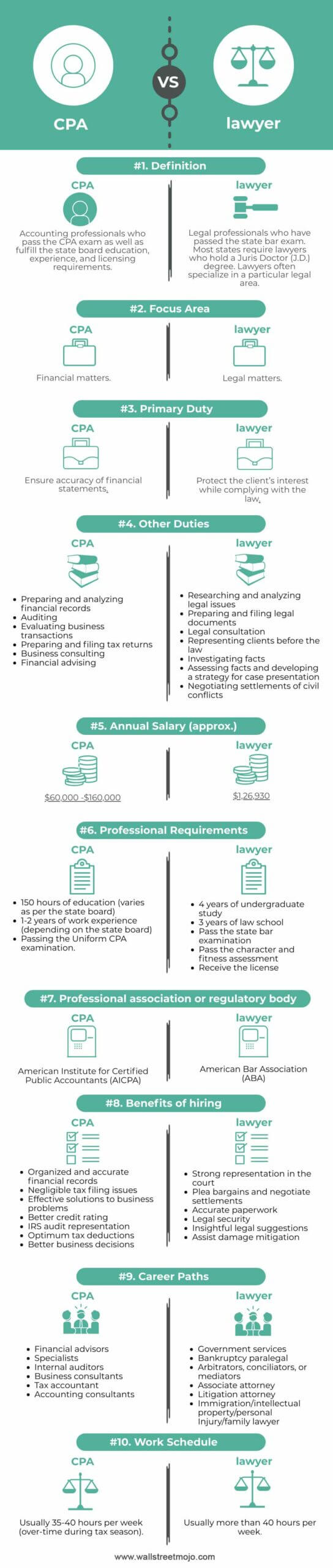

A CPA is a certified public accountant and tax specialist while a tax attorney is a legal professional with a law degree. Skip to main content. Tax Attorney Vs.

Tax Attorney Vs Cpa Salary. By Zippia Expert - Sep. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them.

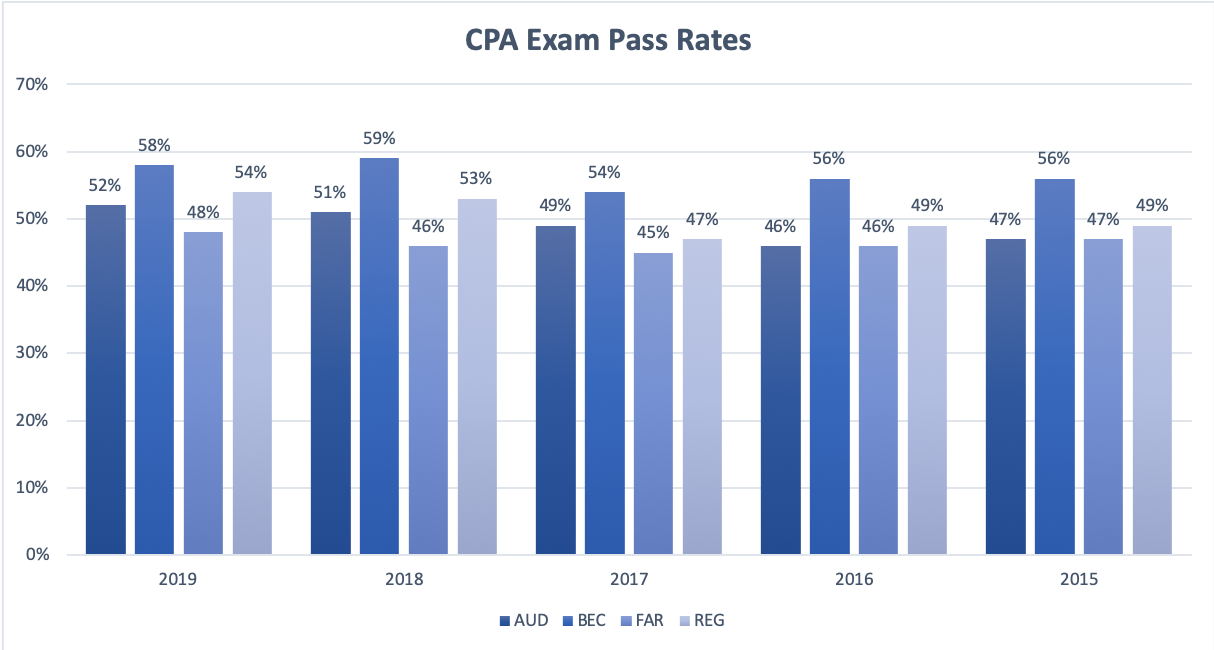

Tax Attorney Salary. A Tax Attorney has a median salary of about 102K per year. Nov 01 2021 tax attorney salary with cpa compensation levels for today s tax professionals the cpa journal.

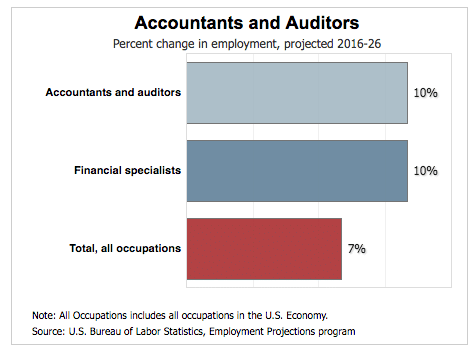

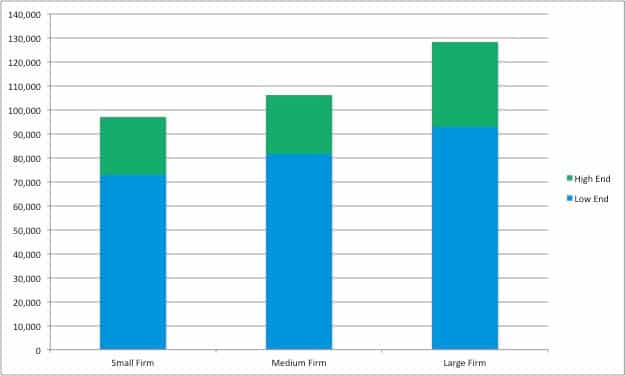

The average CPA salary in the US is 62410 but it also varies depending on your years of experience firm size and industry. Entry-level tax attorney job salary ranges from 77735 to 105498. By Xavier Boyle Published 10 months ago Updated 2 months ago CPAs generally charge less for services than tax attorneys.

Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often. If you become a CPA you have the ability to. A tax attorney can act as a liaison between a client and the Internal Revenue Service often minimizing penalties or negotiating payment terms.

Apply to Attorney Associate Attorney Policy Analyst and more. Whether you need to hire a CPA or a tax attorney depends upon your tax needs. Consequently tax lawyers typically earn higher-than-average salaries a reflection of their.

Tax Attorney Vs Cpa Salary - The Ultimate List of Tax Deductions for Online Sellers in However there are a few advantages and disadvantages of each.

Which Is More Difficult Cpa Or Bar Exam I Took Both And Here S My Answer Accounting Today

Cpa Salary Guide 2022 Find Out How Much You Ll Make

Is A Cpa The Same As An Accountant There Is A Difference

Cpa Tax Accountant Resume Sample Kickresume

Cfa Vs Cpa Salary Who Makes More Kaplan Schweser

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

What Do Tax Lawyers Do Career Path Corporate Tax Lawyer

/certified-public-accountant-or-cpa-careers-1286929-669aa33715f442248c7fbf1ef97898ee.png)

Certified Public Accountant Cpa Job Description Salary Skills More

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Enrolled Agent Vs Cpa Which One Is Better For You Beat The Cpa 2022

Is A Cpa The Same As An Accountant There Is A Difference

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Cpa Vs Non Cpa Infographic Uworld Roger Cpa Review

/forensic-accountant-job-information-974648-FINAL-65b655150eb34d65996f8df01b3a68d2.jpg)

Forensic Accountant Job Description Salary More

What Does A Tax Lawyer Tax Attorney Actually Do That Is Different From Say An Accountant Or A General Practice Lawyer Quora

Average Certified Public Accountant Cpa Salary Range And Compensation 2022